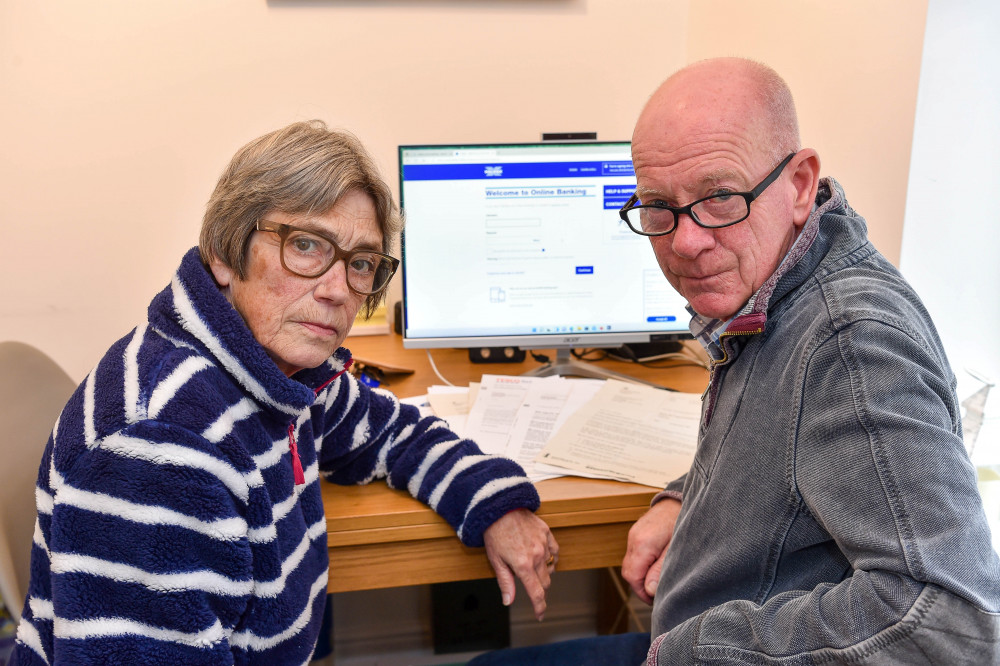

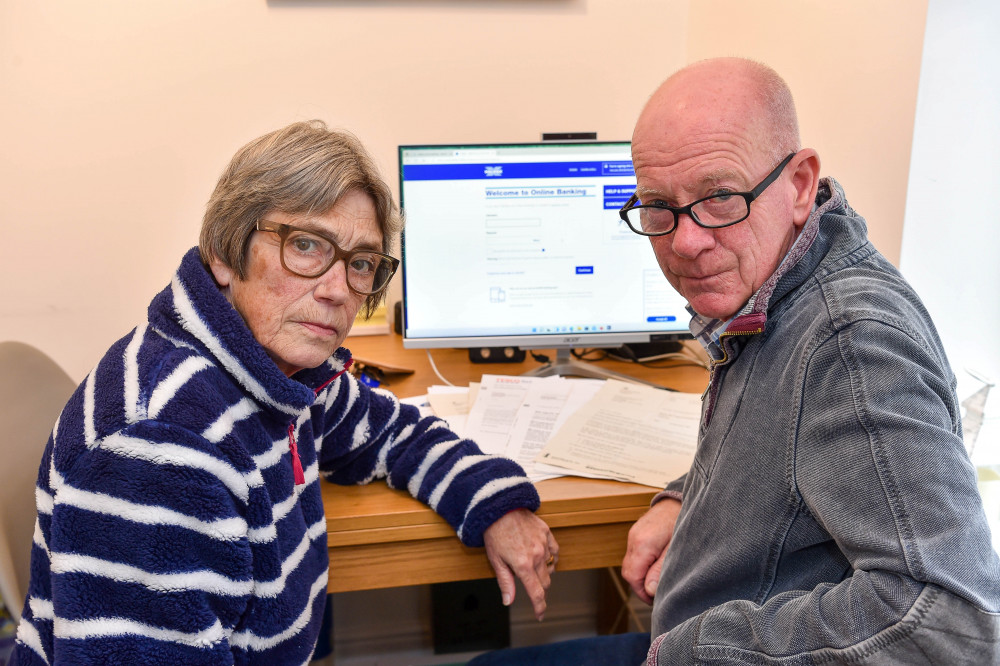

Husband and wife left baffled when both were contacted - and told the other had been declared dead

By James Smith 23rd Oct 2022

A husband and wife were left baffled when both were contacted - and told the other had been declared dead.

Ben Gibson, 63, says he was stunned to be told his wife Gill, 65, was dead when he called her bank about a card problem.

And Ben then returned home later that month to find Gill looking at letters of condolence - for his own death.

Halifax, the couple's bank, has launched a probe and as yet are unable to say how the error occurred.

But caterer Ben, from Stratford-upon-Avon, says he is angry as he has had to waste time sorting out the problem.

He said: "The guy on the phone said, 'Excuse me sir but your wife has deceased'. I said, 'No she's in the front room - do you want to speak to her?'.

"I'm furious about it. I dread to think how much time I've spent on this - hours and hours.

"It has been an absolute nightmare. We've had to rebuild our entire financial life and that's not easy.

"It's been a constant worry. It's horrible, and it's been going on for a long time."

Gill, a teaching assistant, went to the bank on August 15 to replace her card after it didn't work when she was shopping.

Ben's own card also stopped working just a week later, he says, so he ordered a replacement.

But, while his arrived after a few days, Gill's still hadn't appeared.

Ben then called the bank, with whom they have been with for decades, on September 1 - to be told his wife had passed away.

Despite staff chatting with Gill and agreeing she was alive, the account remained frozen and the grandparents-of-four had to go through the bereavement team before they could get any of their money.

More problems then followed when Ben returned home to find shaken Gill looking over letters at their dining table on September 24.

The post, addressed to the executors of Ben's estate from the DVLA and his car insurers, explained the bank had stopped payments to them - because he was dead.

The letter from the DVLA said: "We have been advised that the bank account in the name of Benjamin Gibson has been closed due to the death of the account holder. Please accept my condolences."

The parents-of-three say they have since had to reopen numerous accounts.

And although the DVLA and car insurance was sorted quickly, Ben explained he was still reinstating cancelled payments in and out of the account at the end of September.

The bank explained to him that an external agency had declared Gill dead, but no reasons was offered for his own apparent demise, he said.

"To be fair, the lady at the bereavement service was mortified," Ben said.

"There are websites where you can go and say someone has died, all you need is to say where they bank, you don't even need the account number.

"They're meant to help relatives after someone has died, but the bank should have some way of verifying the information.

"This could have been malicious, it's actually very scary. We're fortunate to have a little put to one side in another account, but what if we didn't.

"Not everyone has friends or family they can borrow from."

Gill said: "This whole thing has been a total nightmare. I would like to know who can inflict this on anyone - my mental health is in tatters.

"Ben has worked tirelessly to try and sort this out.

"When Ben told me the Halifax operator said I was deceased and wanted to speak to me I was numbed and shocked it was if the stuffing had been knocked out of me.

"I still feel like that."

The couple say they were paid £300 in compensation on September 12 and a further £200 on October 3.

Halifax is part of the Lloyds Banking Group.

A Lloyds spokesperson said: "We're really sorry for the upsetting experience Mr and Mrs Gibson had and we are urgently investigating how this happened.

"We have removed the block from their account and made a payment in recognition of their experience."

CHECK OUT OUR Jobs Section HERE!

warwick vacancies updated hourly!

Click here to see more: warwick jobs

Share: