Warwick man among five gang members arrested in suspected multi-million pound fraud probe

By James Smith 12th Dec 2022

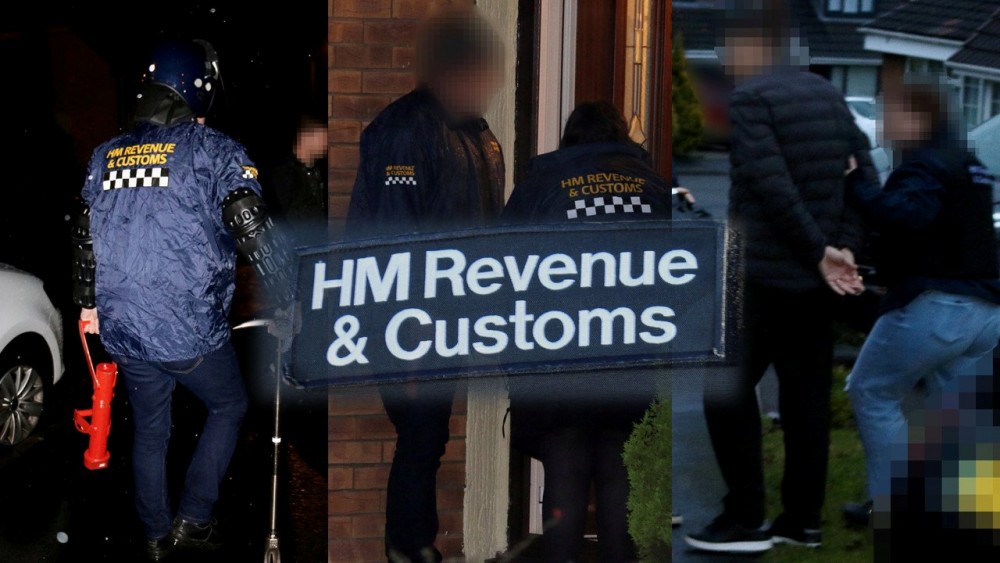

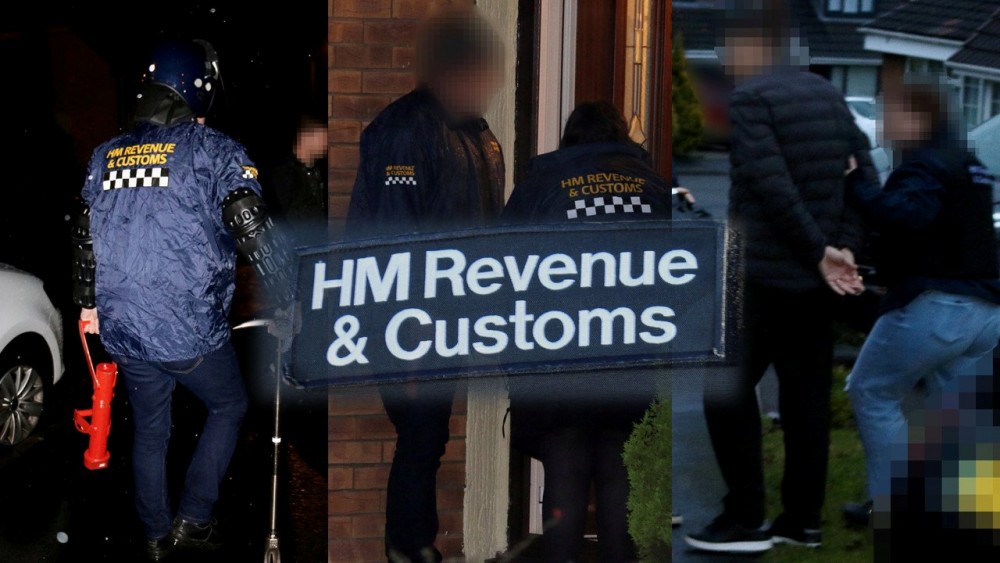

A 49-year-old-man from Warwick is among five people from a gang arrested on suspicion of being behind a multi-million pound global fraud using software to hide till sales.

The till system, an Electronic Sales Suppression (ESS) tool, manipulates businesses takings to evade paying tax.

Sales are put through the till as normal, but the system allows records to be manipulated by deleting sales and routing card payments through an offshore bank.

HM Revenue and Customs has used data to identify thousands of potential users evading tax, and visited 90 businesses across England, Scotland and in a week of coordinated action.

These businesses can now make a voluntary disclosure to correct their records and pay the right tax. HMRC will follow up with those who don't come forward, which could lead to more severe penalties.

It is suspected that the system was designed and sold by a group based in Staffordshire.

The group is also suspected of selling the system to businesses in the US and Australia, where operations were carried out during a week of 'ground-breaking operational alliance'.

HMRC's Director of Fraud Investigation, Simon York, said: "This was a highly sophisticated, truly global attack on the UK and our international partners.

"The group behind this activity is suspected of enabling thousands of businesses to evade tax in what is a large-scale, technologically enabled fraud.

"HMRC's ground-breaking response, with internationally co-ordinated action, marks a significant moment in our efforts to close the net on those we suspect of designing, supplying and using electronic sales suppression software.

"Most businesses pay the tax that they owe. HMRC is on the side of this honest majority and our action helps to ensure they are not being under-cut by tax-evading competitors.

"This is just the beginning of our work in this area, and we already have other suspected suppliers in our sights. We are urging all users of these types of systems to come to us, before we come to them."

Those arrested include a 35-year-old man from Newcastle-Under-Lyme, Staffordshire, a 49-year-old-man from Warwick, a 38-year-old-man from Stoke-on-Trent, Staffordshire, a 36-year-old-man from Stoke-on-Trent and a 56-year-old woman arrested in Luton, all on suspicion of various tax fraud and money laundering offences.

HMRC has a voluntary disclosure facility and would encourage anyone using ESS to contact them. By making a disclosure now those deliberately misusing their till system could see their financial penalties reduced.

Information on making a disclosure can be found on gov.uk

CHECK OUT OUR Jobs Section HERE!

warwick vacancies updated hourly!

Click here to see more: warwick jobs

Share: